FHFA Proposes New Affordable Housing Goals

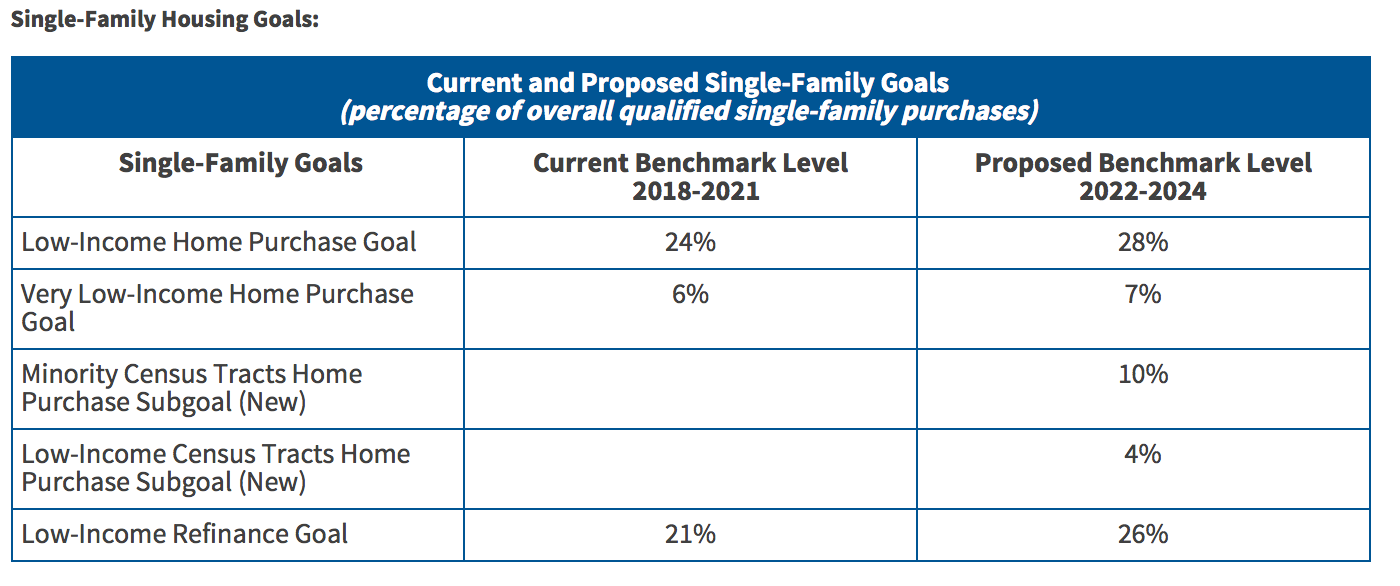

The Federal Housing Finance Agency proposed a set of new housing goals that target assisting low- and moderate-income families, minority communities, rural areas, and other underserved populations achieve homeownership. FHFA outlined the goals for the mortgage financing giants it regulates—Fannie Mae and Freddie Mac—for 2022 to 2024.

Its new minority census tract is aimed at improving access to fair and sustainable mortgage financing in communities. A mortgage qualifies if it is located in a census tract where the median income is below the area’s median income and where minorities comprise at least 30% of the population.

“The new subgoal for minority census tracts was designed to help preserve and support affordable housing in communities of color,” says Sandra Thompson, FHFA’s acting director. “The subgoal benefits families at or below area median income, allowing them to stay in the communities they helped build. [Fannie Mae and Freddie Mac’s] housing goals over the next three years should support equitable access to sustainable affordable housing opportunities in a safe and sound manner that bolsters the health of communities.”

The percentage of mortgage purchases by Fannie Mae or Freddie Mac in the category must exceed either the benchmark level set or the market level for that year, FHFA explains.

FHFA will accept comments on its proposed rule over the next two months once it’s published in the Federal Register.

Source: REALTOR® Magazine