New-Home Construction Is Expected to Grow in 2024

Builders are using more sales incentives to win over house hunters who are frustrated with a lack of existing inventory, data shows.

Home buyers who have been frustrated by a lack of inventory are increasingly looking to builders for more housing options. Builders have been ramping up construction since last year, and they’re answering buyers’ affordability concerns with sales incentives, like buying down mortgage rates or assistance with closing costs.

“The new-home market is becoming a dominant player, and we expect that to continue in 2024,” Ali Wolf, chief economist with housing research firm Zonda, said at a press conference Tuesday during the International Builders’ Show in Las Vegas.

New-home sales traditionally account for about 10% to 12% of the market for single-family homes but recently have comprised more than 30%. A shortage of existing homes has plagued many markets as homeowners remain reluctant to sell. “The shortage of existing homes For Sale has opened up the possibility of new-home construction to more buyers who may not have once considered it,” said Danielle Hale, chief economist at realtor.com®.

Forty percent of home buyers say the top reason they considered buying new was to “avoid renovations or problems,” followed by a lack of existing inventory (25%) and the ability to choose and customize their home’s design (25%), Wolf said, citing Zonda’s research.

Plus, as existing-home prices surge to record highs, home builders are addressing buyers’ affordability concerns. “It’s very important to address buyers’ fear and those who are nervous where prices are,” Wolf said. “To get them to feel more comfortable, they need to at least feel like they’re getting a deal.” Builders increasingly are offering sales incentives, like funds toward closing costs (up to $20,000) or “flex dollars” to use toward home upgrades. Wolf says the most popular incentive has been mortgage buydowns.

Builders Have a Bullish 2024 Outlook

Single-family housing starts nationwide are forecast to increase 4.7% this year and another 4.2% in 2025, reaching a pace of 1.3 million units, according to NAHB. Still, economists are calling for builders to do even more. “We need to build more than 1.15 million single-family homes a year to reduce the nation’s housing deficit,” said Robert Dietz, chief economist of the National Association of Home Builders. But builders point to higher prices and shortages of lumber, lots and labor for stifling their ability to build more. Further, Dietz pointed to rising regulatory costs in complying with building codes and zoning issues, which are comprising nearly 24% of the final sales price—or $93,870—for a new single-family home.

Despite the headwinds, builders remain optimistic because of rising consumer demand. Eighty percent of builders anticipate starting more homes this year, and 51% expect starts to increase more than 10% compared to 2023, Wolf said.

The Townhouse Boom

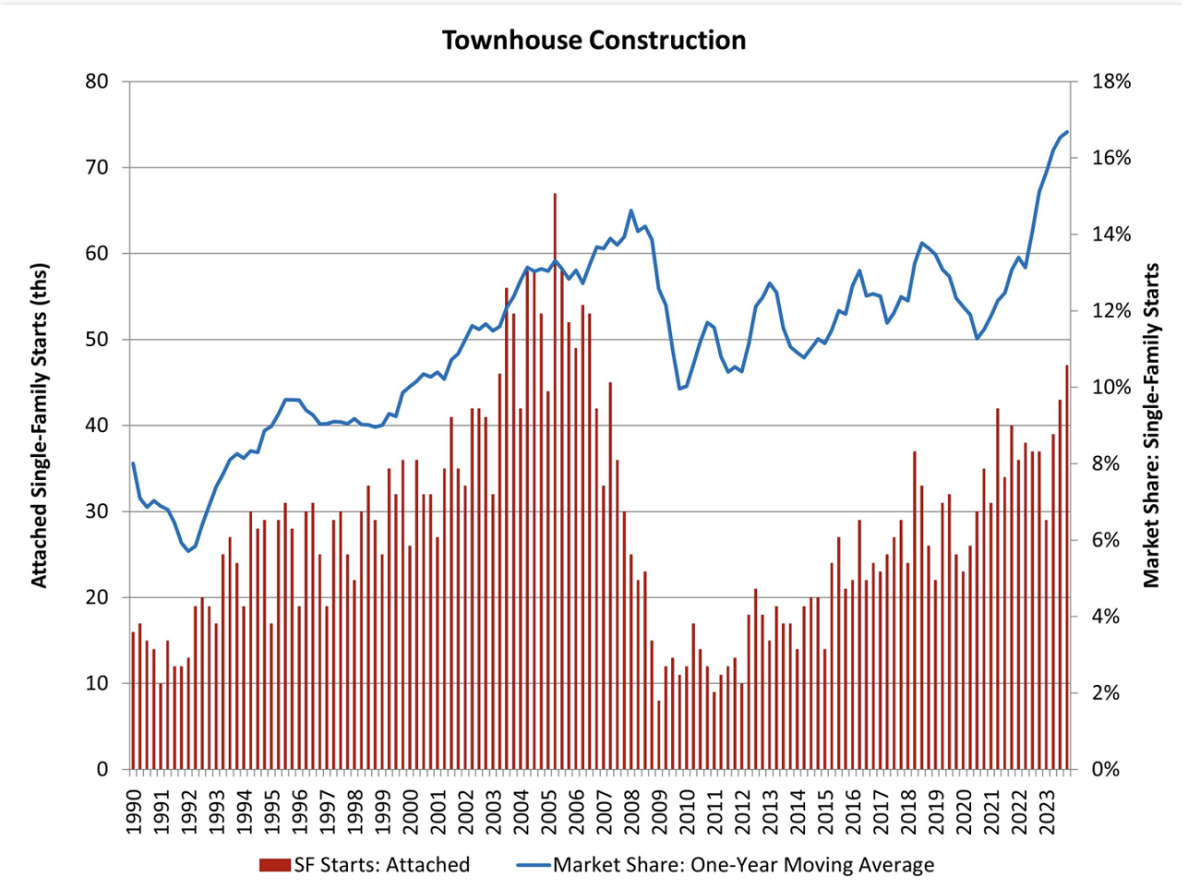

Builders may be looking to vary their products in response to affordability and lot woes. Townhome construction, for example, surged to its highest rate in more than 17 years, according to an NAHB analysis of Census data. The single-family attached housing style, which often comes with a lower price tag, may become a growing option for home buyers.

Single-family attached starts were 27% higher in the fourth quarter of 2023 than in the fourth quarter of 2022. Overall, townhouses accounted for nearly 20% of the total housing starts in the final quarter of 2023.

“Townhouse markets are one of the bright spots” in the new-home sector, Dietz said, adding that he’s bullish on the sector continuing to outperform. Dietz points to a growing number of home buyers—young and old—who are looking for medium-density residential neighborhoods, such as urban villages that offer walkable environments and other amenities.