What Buyers Truly Need

Focus should be on inventory—not on jeopardizing the consumer experience.

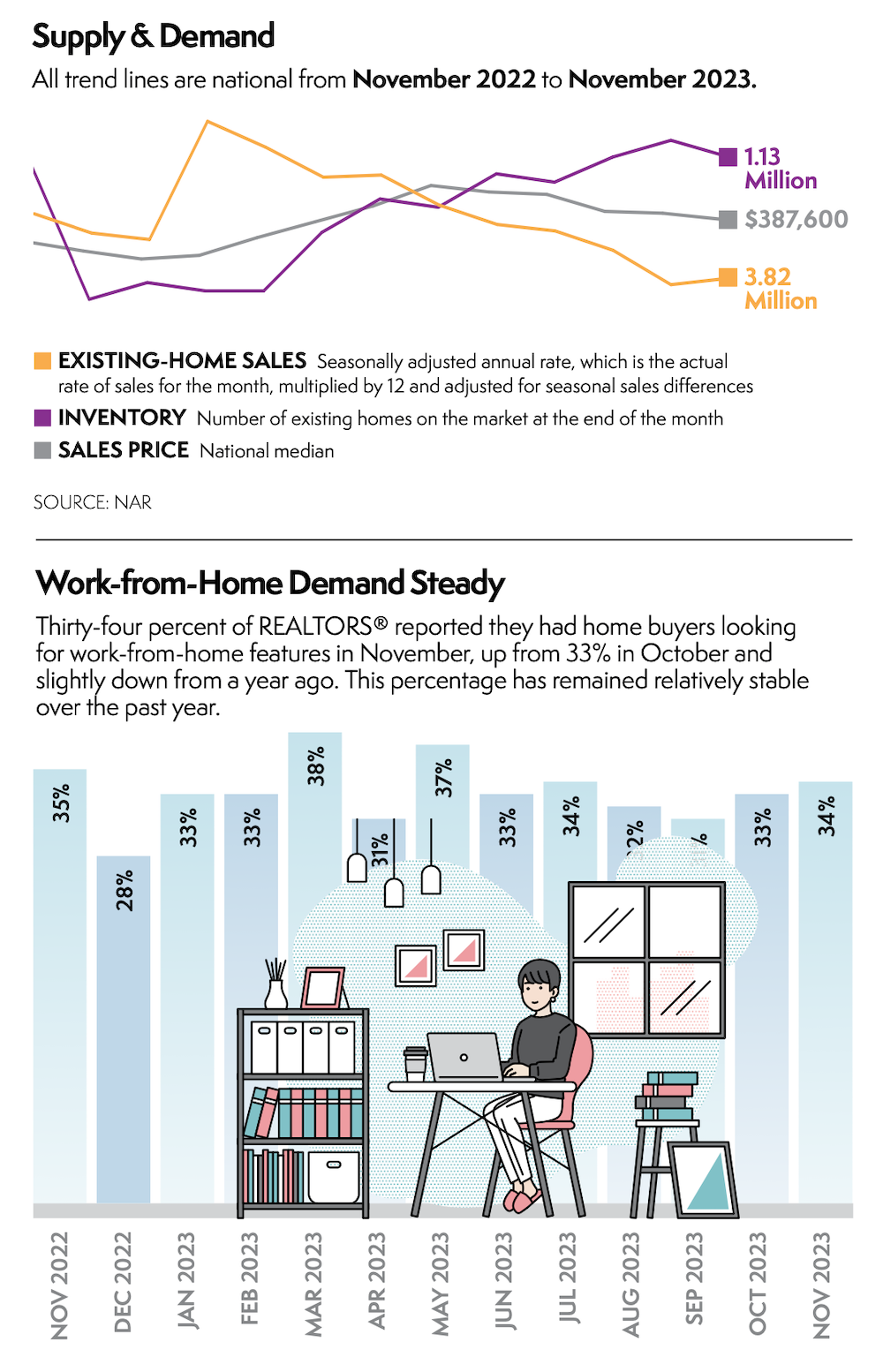

Last year was one of the best performances for new-home sales, yet it was the worst for existing-home sales since 2008. New-home sales were lifted by a 33% increase in inventory and by builders constructing homes at lower price points. Existing-home sales, by contrast, were hindered by an inventory that’s around half of pre-pandemic levels. Despite higher interest rates, one-third of existing homes for sale received multiple offers, meaning multiple unhappy buyers left empty-handed.

Consumers who succeeded in the transaction were certainly content with their professional representation. A super-majority, 75%, indicated in NAR’s latest Profile of Home Buyers and Sellers that they would definitely use the same agent in the future; another 15% indicated “probably.” The figures are consistent with previous years. That’s why so many of our members say referrals are a top business source. Meanwhile, their clients have done quite well over the years; the typical homeowner’s median net worth is nearly $400,000.

Since the year 2000, there have been 127 million existing-home sales. Extrapolating, that’s 114 million content buyers. As with any business, there will always be unhappy customers who will take their business elsewhere the next time. That’s why, in a competitive industry, some businesses fail and new competitors enter. Over 100,000 new agent-entrepreneurs joined NAR in 2023, and just as many left the business. With more than 200,000 brokerages in the U.S., consumers are free to choose fee-for-service, full-service or any alternative including do-it-yourself.

Rather than acknowledging the competitiveness of the industry, some lawyers want to take it to court over cooperative compensation. These lawyers throw around the term “cartel,” though there’s no evidence that collusion occurred, and collusion among so many competitors would be impossible. Who stands to be hurt most by these lawsuits? Consumers, especially first-time and first-generation buyers.

Pick-up in First-Timers

First-time buyers traffic made up 31% of sales in November, up from 28% in October 2023 and November 2022. NAR’s Profile of Home Buyers and Sellers revealed that the first-time buyers’ annual share was 32%.

Source: REALTOR® Magazine